The Real Cost of That “Perfect” Hire: Why It’s Higher Than You Think

Cost per hire (CPH) has increased by 14% in four years—and you’re probably still underestimating it.

According to the Society for Human Resource Management (SHRM), the average cost of hiring an employee has increased from $4,129 in 2019 to $4,700 in 2023.

At first sight, $4,700 does not seem to be a staggering figure. But here’s what most talent leaders overlook: The $4,700 figure only includes direct, trackable costs like job postings, recruiter fees, and agency expenses. What it overlooks are the hidden costs that gradually accumulate, often making the true cost of hiring far higher than most leaders realize.

The Real CPH: 30–50% Higher

While you are celebrating that “perfect” candidate—great skills, cultural fit, the complete package—your actual hiring investment could range anywhere between $6,100 to $7,050 per hire. That is 30–50% higher than the standard cost per hire formula suggests.

The difference? Hidden costs that traditional cost per hire calculators do not account for.

The Hidden Costs Nobody Tracks

- Hiring Manager Time: The time spent on interviews, resume reviews, and coordinating with candidates could otherwise be utilized for strategic goals.

- Productivity Loss During Extended Vacancy Periods: Every extra week that a position remains unfulfilled implies missed deadlines, stretched teams, and a significant loss of revenue.

- Administrative Overhead: From IT setup to onboarding paperwork, the “behind-the-scenes” efforts consume time and resources.

- The Cost of Mis-Hires: When the so-called “perfect” hire doesn’t last, the cycle starts all over again—at double the cost.Most organizations track the visible expenses but ignore the soft and opportunity costs. The blind spot does not just distort reporting—it creates a talent acquisition budget crisis waiting to happen.If hiring costs continue to increase by 14% every few years, underestimating your true CPH could disrupt workforce planning and eat into margins faster than expected.Tracking surface-level CPH is no longer sufficient. You need to track the right costs—the hidden ones that influence your hiring ROI. In today’s market, the difference between $4,700 and $7,000 per hire is more than an accounting detail. It is the gap between sustainable growth and a looming budget crisis.

Understanding CPH—And Why the Basic Cost Per Hire Formula Falls Short

Cost Per Hire is one of the most widely used recruitment metrics. It calculates the total cost an organization spends to fill an open position, including everything from job ads and recruiter fees to interview, travel, and onboarding costs.

At its core, it answers one simple question: What does it really cost to hire a new employee?

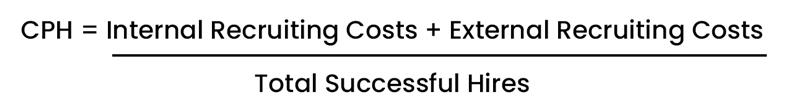

The cost per hire formula, as defined by the American Standards Institute (ANSI) and the Society for Human Resource Management (SHRM), is:

While the cost per hire formula offers a useful starting point, its scope still is limited.

Here’s why:

- Accumulated Hidden Costs: Delay in filling positions, interview panel hours, and the cost of a mis-hire are often unnoticed, while having a significant impact on the bottom line.

- Complexity of Role: Hiring a software engineer, for example, is significantly less expensive than hiring for an executive role, which might cost $35,000 or more in the United States.

- The Full Picture of Recruitment Efficiency: To accurately measure recruitment efficiency, CPH must be combined with metrics like time-to-hire, quality of hire, and turnover costs.

That’s why leaders need a complete hiring cost breakdown.

Measuring Internal Recruitment Costs: Key to Smarter Hiring Budgets

Internal recruitment costs include expenses an organization incurs within its own operations to attract, evaluate, and onboard new hires. These costs represent the time, resources, and infrastructure dedicated to managing the hiring process in-house.

Typical internal recruitment costs include:

- Talent Acquisition Team Salaries: Compensation for in-house recruiters or HR team members.

- Interview Costs: Time and effort invested by hiring managers and employees participating in interviews.

- Employee Referral Bonuses: Incentives for employees who refer successful candidates.

- Recruitment Technology: Costs for applicant tracking systems (ATS), assessment platforms, and other hiring tools.

- Internal Training: Expenses for upskilling talent acquisition teams on processes and technology.

Since internal recruitment costs are closely related to CPH statistics, they provide useful insights into hiring efficiency. High internal costs may indicate time-consuming processes or dependency on internal staff, whereas automation, better technologies, and streamlined communication can significantly reduce these expenses.

External Hiring Costs: The Budget Line Items That Add Up Fast

External recruitment costs are the expenses an organization pays to third-party vendors, platforms, or services during the hiring process. They form a significant part of CPH and exclude any expenditure incurred after a person joins the organization, such as training or onboarding charges.

Tracking these expenditures helps organizations:

- Evaluate ROI on outsourced recruitment activities

- Optimize budgets through identification of high-cost areas

- Enhance hiring efficiency with better cost allocation strategies.

A few examples of external recruitment costs include:

- Advertising & Marketing Expenses: Include the costs for job board postings, social media campaigns, or sponsored ads.

- Third-Party & Agency Fees: Payments to recruitment agencies, headhunters, background verification agencies, or external recruiters for sourcing candidates.

By closely monitoring external recruitment expenses, organizations gain better visibility into hiring expenditure, enabling them to eliminate wasteful costs while preserving—and even improving—the quality of hires.

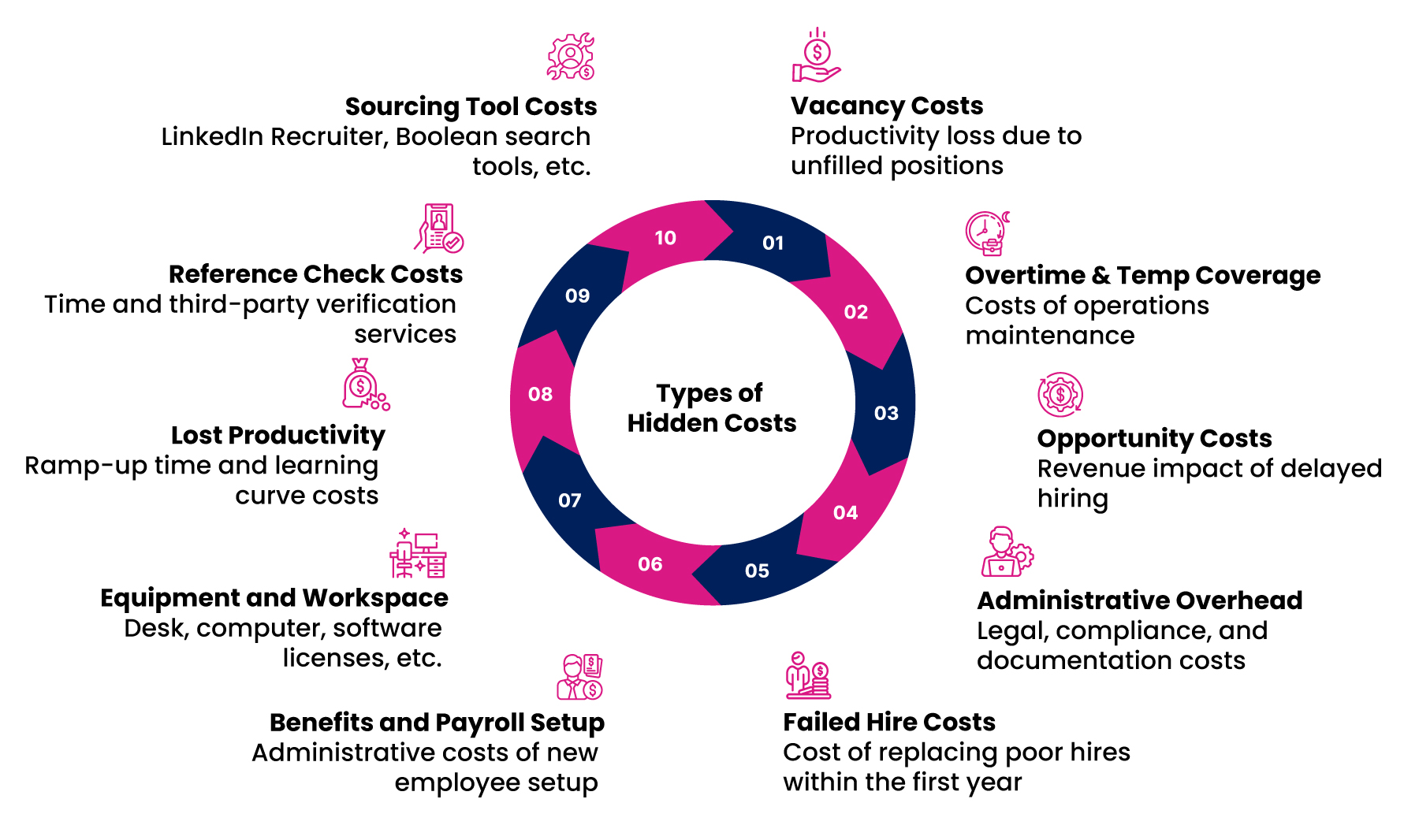

Uncovering Hidden Costs: The True Price of Hiring

Most cost per hire calculators only capture what is apparent to the human eye: Job board fees, recruiter salaries, and agency markups are documented on invoices and get tracked religiously. But the real budget killers? They are hiding in plain sight.

Vacancy Costs: The Price of Empty Chairs

Every unfulfilled position bleeds productivity. Sales territories go uncovered. Projects get delayed. Customer service queues grow longer. While you chase the ‘perfect’ candidate, the empty desk is draining your bottom line.

The impact is measurable for revenue-generating positions. A vacant sales position does not just cost you the hire, it costs you every deal that the resource would have closed. For support roles, the damage spreads differently: teams stretch thin, quality declines, and the risk of burnout skyrockets.

Overtime and Temporary Coverage: Keeping the Lights On

Vacancies do not pause work; they just push it to another location. Teams log expensive overtime. Temporary workers fill in at marked-up hourly costs. Responsibilities get redistributed, often inefficiently.

These “bridge costs” escalate quickly. A single open position can drive weeks of overtime across multiple employees, and temporary staffing fees that often surpass the salary of a full-time hire.

Opportunity Costs: The Revenue that Disappears

This is the blind spot in nearly every cost-per-hire model, the revenue lost while vacancies remain unfulfilled.

Unfilled engineering positions delay product launches. Empty sales territories miss quota. Understaffed support teams drive customer churn during peak periods. Critical initiatives stall when leadership positions remain vacant.

These aren’t just hiring expenses. They are the business costs closely related to your recruitment timeline.

Administrative Overhead: The Paperwork Trail

Every new hire sets off a chain reaction of administrative tasks that rarely make it to CPH calculations.

- Legal reviews of offer letters and employment agreements

- Compliance documentation and I-9 verification

- Background check coordination and follow-up

- Reference verification calls and documentation

- Processing and filing of onboarding paperwork

Every step consumes time across multiple departments, creating a distributed cost structure that is rarely included in CPH calculations.

Failed Hire Costs: When ‘Perfect’ Goes Wrong

Industry research reveals a hard truth: Nearly 1 in every 5 new hires won’t make it past their first year. When that happens, you don’t just lose their salary. Every unsuccessful hire costs you the investment you made in recruiting, onboarding, and training, in addition to the cost of replacing them.

Failed hire costs include:

- Wasted initial recruitment expenses

- Lost onboarding and training investments

- Productivity disruption during their employment

- Severance or termination costs

- A complete restart of the hiring cycle

For senior positions, failed hire costs can easily equal 6-12 months of that position’s salary. The message is clear: Failed hires aren’t just HR setbacks. They are business risks with bottom-line impact.

Benefits and Payroll Setup: The New Hire Infrastructure

Hiring someone officially involves more than just signing an offer letter. It sets in a complicated infrastructure that affects multiple teams:

- Benefits enrollment and administration

- Payroll setup and tax withholding

- Insurance carrier notifications and updates

- 401(k) or retirement plan enrollment coordination

Every new hire needs dedicated time from HR, payroll, and benefits administration teams—yet these costs are rarely included in CPH calculations.

Equipment and Workspace: The Often-Ignored Capital Expense

Every new hire represents a physical (and digital) investment:

- Desk, chair, and workspace setup

- Computer hardware, peripherals, and secure access

- Software licenses and specialized tools

- Phone setup, telecom, and connectivity support

- Office supplies and initial equipment

For remote employees, this might include home office stipends, shipped equipment, and IT support for setup. For technical roles, specialized software licenses can cost hundreds or thousands of dollars annually.

These essential investments are rarely captured in CPH metrics. Therefore, rather than viewing this as a strategic cost driver, leaders ignore it as ‘background noise’.

Lost Productivity: The Hidden Cost of Ramp-Up

No employee delivers from day one. Even experienced professionals must navigate procedures, adjust to new systems, and build relationships with coworkers. During this ramp-up phase, new hires are generating costs without reaching their full productivity.

For complex roles, the learning curve stretches anywhere between three to six months. For senior positions, it could be longer. This learning curve represents a measurable cost; the salary and benefits paid during below-capacity performance. Proactive HR leaders understand that ramp-up time is not just a talent challenge, it is a critical variable in workforce planning and ROI.

Reference and Background Check Costs: The Underestimated Cost of Due Diligence

Although every organization understands the need for careful screening, few truly consider the actual investment behind it. In addition to the costs for background screening, the process demands significant time and coordination:

- Coordination with previous employers and references

- Following up on incomplete or delayed responses

- Additional screening for sensitive or high-security roles

- Time spent conducting reference calls

For positions that need security clearances or specialized certifications, verification might take weeks, absorbing dedicated staff attention throughout.

Sourcing Tool Costs: The Technology Stack

The sophisticated technology stack that powers modern recruitment is rarely included in CPH calculations. From sourcing to screening, every step makes use of the platforms with real price tags:

- LinkedIn Recruiter licenses and InMail credits

- Boolean search and candidate database subscriptions

- Assessment platform fees and usage costs

- Video interviewing software and scheduling tools

- Applicant tracking system per-hire allocations

These tools are now table stakes for competing in the talent market. However, since such costs are treated as overheads and not direct hiring expenses, organizations underestimate the true CPH.

The tech stack isn’t just infrastructure—it is a direct contributor to both speed and quality of hire. Treating it as anything less can distort hiring ROI and underfund one of the most strategic levers in talent acquisition.

Why Role Economics Matter in Hiring

Not every hire has the same cost—or impact. Both the upfront cost-per-hire (CPH) and the actual annual investment vary by the role type. Leaders who want to optimize workforce strategy must look beyond averages and factor in the true economics of each role.

Important Benchmarks to Keep in Mind

- Frontline Roles: The CPH is between $1,500–$3,500, but with more than 50% turnover, the true cost exceeds $4,000 per seat annually.

- White-collar Roles: Range between $5,000–$15,000+ CPH, with higher retention driving stronger ROI over time.

- High-volume Hiring: $1,000–$2,500 CPH through efficiency, but quality control challenges prevail.

- Niche/Executive Hires: Can prove to be costly, ranging between $15,000–$50,000+ CPH, but can severely impact business performance if these positions remain vacant.

- Contingent Talent: Markup between 20–40%, with permanent hires typically reaching break-even in 6–12 months.

- Frontline vs. White-Collar Trade-offs

- Frontline Hiring: This prioritizes speed and scale, but the hidden cost is turnover. With 60% attrition, you’re effectively hiring 1.6 employees to fill one seat filled annually.

- White-collar Hiring: While the initial CPH is higher, the benefits include improved retention, cultural alignment, and long-term ROI.

- High-Volume vs. Niche Role Economics

- High-volume Roles: Efficiency gains are real, but it can also compromise quality.

- Niche or Executive Roles: These vacancies can have significant business impact. The difference between backfilling a warehouse associate and a CTO demonstrates how high the stakes can be.

- Contingent vs. Permanent Break-Even

- Contingent hires may appear flexible and cost-efficient, but the hidden expenses—compliance, higher turnover, and the loss of institutional knowledge—quickly erode the value.

- Permanent hires have a higher upfront investment, but long-term benefits compound through productivity, engagement, and retention. The break-even is typically reached within 6–12 months.

To calculate cost per hire, we must factor in role complexity, not just averages. A $10,000 engineer who works for four years with an organization adds exponentially more value than four $2,500 retail hires who leave every six months. Strategic hiring requires more than tracking averages, it also entails allocating budgets based on role economics and investing differently across frontline, white-collar, high-volume, niche, and contingent roles to maximize organizational impact.

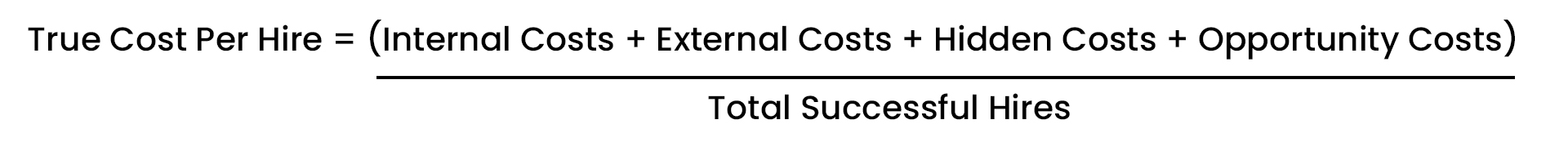

The Complete Cost Per Hire Formula

Calculating the true CPH goes beyond the basic recruitment expenses. The true cost of hiring varies considerably since it is influenced by hidden costs, time constraints, role complexity, and industry dynamics—all of which traditional calculations overlook.

The Enhanced CPH Formula:

Below is what each component covers:

- Internal Costs: Recruiter salaries, HR overhead, and interview time

- External Costs: Job boards, agency fees, and background checks

- Hidden Costs: Relocation, onboarding, and administrative expenses

- Opportunity Costs: Lost productivity, revenue impact of vacancies, and delayed projects

Why Costs Differ

- Time to Hire: Longer timelines lead to higher opportunity costs, while urgent hires increase agency and assessment fees.

- Role Complexity: Executives and niche roles require specialized recruiters, headhunting, and longer search timeframes, while frontline roles typically have higher turnover despite lower upfront costs.

- Industry Dynamics: High demand for rare skills in IT and healthcare increases expenses, while retail and hotels may hire in bulk yet experience attrition.

Why Complete Formula Matters:

- Transparency: Tracks every dollar spent.

- Strategic Insights: Reveals trade-offs between cost, speed, and quality.

- Aligned Strategy: Ensures hiring decisions match real-world business needs.

By factoring in hidden costs, deadlines, and role-specific variables, organizations gain a clear picture of hiring investments, allowing them to proactively plan for long-term success.

Direct Sourcing: The Key to Lowering Cost Per Hire

Direct sourcing is transforming talent acquisition by offering organizations a faster, more cost-effective hiring solution. Instead of relying on third-party agencies and paying high markups, organizations utilize their own brand, networks, and data to build curated talent pools and hire directly, leading to considerable cost savings and improved candidate quality.

The impact on CPH is clear: Organizations that utilize direct sourcing save 25-45%, depending on hiring volume and role type.

How Direct Sourcing Reduces Cost Per Hire

Direct sourcing goes far beyond replacing agencies. It considerably reduces expenses at every stage of the hiring lifecycle.

- Elimination of Agency Fees

- Reduces agency markups by 15–30%.

- Eliminates third-party commissions and dependency costs.

- Faster Time-to-Hire = Lower Vacancy Costs

- Use pre-vetted talent pools and talent communities to fill positions faster.

- Reduces vacancy-driven productivity loss and overtime costs.

- Stronger Cultural Alignment = Higher Retention

- Using employee networks, alumni, and referrals helps candidates understand the culture better.

- Better fit reduces failed hires and replacement costs.

- Streamlined Administrative Overhead

- Internal processes mean fewer agency contracts, invoices, and compliance requirements.

- Automation and AI reduce manual sourcing and screening time.

- Smarter Advertising Spend

- Data-driven job advertising targets the right candidates, reducing wasteful expenditure.

- Employer branding attracts passive talent organically, reducing dependency on paid channels.

- Reduced Early Attrition

- Optimized onboarding reduces first-year turnover and saves repeated hiring expenses.

- Long-Term Workforce Planning Advantages

- Nurturing talent communities ensures a ready pipeline for critical and high-volume roles.

- Forecasting labor demand helps avoid costly last-minute hiring.

Direct sourcing transforms recruiting from a reactive cost center into a proactive strategic advantage, reducing cost per hire today while building a sustainable, high-quality talent pipeline for the future and improving recruitment ROI.

Why Is CPH More Important Than Ever?

In today’s competitive talent market, cost per hire is no longer a back-office metric; it’s a strategic instrument that directly impacts financial performance, workforce planning, and business growth.

Smarter Headcount Planning and Forecasting

Accurate CPH ensures that hiring decisions are based on facts, not assumptions. It helps organizations:

- Plan annual hiring budgets aligned with business growth targets

- Forecast talent acquisition expenditure across business units, geographies, and role levels

- Identify and address hiring cost increases and take early corrective actions

Defending Budgets with Data

Talent acquisition teams are often under the pressure to ‘do more with less.’ Accurate CPH data helps talent acquisition leaders:

- Justify recruitment budgets with ROI metrics

- Highlight the financial implications of extended hiring cycles or hard-to-fill positions,

- Secure investments for tools, employer branding, or direct sourcing activities

Benchmarking Tools and Vendors

Accurate CPH metrics enable:

- Objective evaluation of agency markups and job board ROI,

- Comparison of internal and external hiring expenses

- Negotiation of better pricing based on actual hiring volume and cost patterns.

Underestimating CPH has major business consequences.

- Hidden costs such as time-to-fill, onboarding, and lost productivity frequently cause budget overruns

- Wrong cost forecasts disrupt workforce planning, leading to over hiring that strains budgets or under hiring that fails revenue targets

- With incorrect data, leaders lose confidence, the case for recruiting investments weakens, and vendors get misaligned—often leading organizations to overspend on agencies or tech that deliver little ROI.

How WorkLLama Redefines Cost Per Hire Through Direct Sourcing

Knowing your cost per hire is important. But what about decreasing it?

That’s where WorkLLama delivers.

Traditional hiring models rely on staffing agencies and job boards, increasing costs through markups, delays, and mismatched candidates. WorkLLama changes the equation with direct sourcing powered by Agentic AI, creating self-sustaining talent communities that reduce waste, time-to-fill, and overall hiring expenses.

Here’s how WorkLLama reduces and maintains CPH:

- AI-Powered Talent Pool Planner: Predict, plan, and adapt hiring needs. WorkLLama uses AI to auto-build dynamic talent pools, so your next best hire is already in the pipeline. This reduces vacancy costs and eliminates last-minute agency dependencies.

- WorkLLama Public Talent Community: Augment your private bench with pre-vetted, auto-sourced candidates—building ready-to-go communities that lower sourcing costs.

- AI Conversational Voice + Chat Agents: From Sofi chatbot to voice assistants, candidates are screened, qualified, scheduled, and nurtured 24/7. No manual effort, no leakage, just faster hires and less overheads.

- Copilot + Smarter Matching: Sofi Copilot acts as recruiter, curator, and marketeer in one. AI matching ensures that you are connected with the right people, minimizing costly mis-hires, and keeping the cost per hire low.

- Insights + Integrations: With 60+ ATS and 75+ HRIS integrations, plus advanced analytics, leaders gain visibility into every stage of the hiring funnel—identifying inefficiencies before they inflate budgets.

The impact is measurable: Organizations using WorkLLama report 25–45% reductions in cost per hire, alongside shorter time-to-fill and higher retention. Every dollar saved on agency fees, vacancy costs, and mis-hires is reinvested into building a more agile, future-ready workforce.

In short, while traditional CPH formulas expose the problem, WorkLLama’s direct sourcing capabilities solve it. Not by cutting corners, but by providing smarter, faster, more human ways to plan, source, and deploy talent.

If you really want to know your true CPH and how to reduce it: Try our ROI Calculator.